If you think that market research is only for large corporations with huge budgets, let’s bust that myth from minute one.

The most straightforward definition is that market research is a research process that collects and analyzes data about your target audience, your industry environment and the direct and indirect competition of your ICP or Sector.

It is not simply “asking a few friends what they think of your product”, but structured research that combines quantitative (surveys, statistics, usage metrics) and qualitative (interviews, focus groups, observation) information.

Today, any company – from a startup just out of the oven to an established ecommerce company – can and should do a serious analysis of its market. Why?

Because knowing your customers, your competitors and the trends that move your sector is the compass that prevents you from getting lost in the sea of “let’s try it and see what happens”.

In this article we tell you, with clear, applicable examples that we have seen our clients develop, how to make a market study that really helps you to make decisions, what tools to use and how to take advantage of it to boost your business.

And yes, we will do it with clear, direct and straightforward language, as we like at Clientify. And with some irony and jokes, of course.

What is a Market Study?

Let’s understand what we are talking about or “synchronize clocks”, as they used to say in old war movies.

We have already mentioned that this is a process where you or an external consultant investigates everything related to your offer: target customer, competitive environment, weaknesses, strengths…

The difference between market research and market analysis is key: research is the process of gathering information; analysis is interpreting that data to make decisions. Doing both properly saves you time, money and more than one headache.

If you want to fit it into your overall strategy, here are two essential allies to broaden your knowledge: what is a strategy and how to build your strategic plan.

Steps to do a Market Study

Let’s get to work.

Good market research does not start with surveys or graphs: it starts with a clear question.

What do you want to discover or confirm?

It can range from “is this new product worth launching?” to “why are my sales dropping in the youth segment?”.

Each step should be geared toward answering that question.

Here’s how to do it in an orderly fashion without losing sight of the objective:

- Define the objective of the study

Make sure you are clear on what decisions you will make from this work. Here your marketing manual will be your roadmap. - Identify the target audience

Define segments, buyer personas and segmentation criteria. If you want to prioritize contacts with more buying options, look at what is a qualified lead (MQL). - Select the methodology

Quantitative (data and statistics), qualitative (opinions and perceptions) or mixed. Choose according to the type of response you are looking for. - Collects data

- Primary: surveys, interviews, tests.

- Secondary: reports, studies, trends and data collection.

- Analyze the competition

Identify your position in relation to others and adjust your positioning. - Interpret results

Don’t stop at the “what happened”: look for the “why it happened”. - Apply conclusions to your strategy

Integrate what you learn into your workflows and campaigns.

Useful tools and resources

Here we are not going to get complicated with technology that only four companies in the world use. The tools that will really help you are accessible and easily integrated with your day-to-day life:

- Online forms and surveys: ideal for collecting primary data directly from your audience. With them you can validate hypotheses, detect trends or evaluate customer satisfaction. With Clientify, by inserting the wedge, you can create the forms you need whose data go directly into the CRM.

- CRM: the heart of data organization. It not only stores contacts, but also allows you to segment, tag and activate campaigns based on the information collected (read here how a CRM supports you with data collection, and how to qualify leads).

- Marketing automation: turn what you learn into concrete actions. If you detect a segment with high purchase intent, you can activate automatic sequences to close sales(automate the sales process). At the same time as you do the study, you can connect with potential leads.

- Integrated conversation channels: such as WhatsApp with CRM, which allow you to interact directly with leads and customers, resolve doubts and strengthen the relationship. You can use them as a contact channel to go

Benefits of doing a Market Study

When you work with real data, decisions weigh less on your stomach and more on your head.

The important thing is not to jump into the pool “willy-nilly”. There are companies that do it and some of them do not succeed, but it is not usually the majority, in those cases the luck factor is very important.

Our strong recommendation is to eliminate all uncertainty.

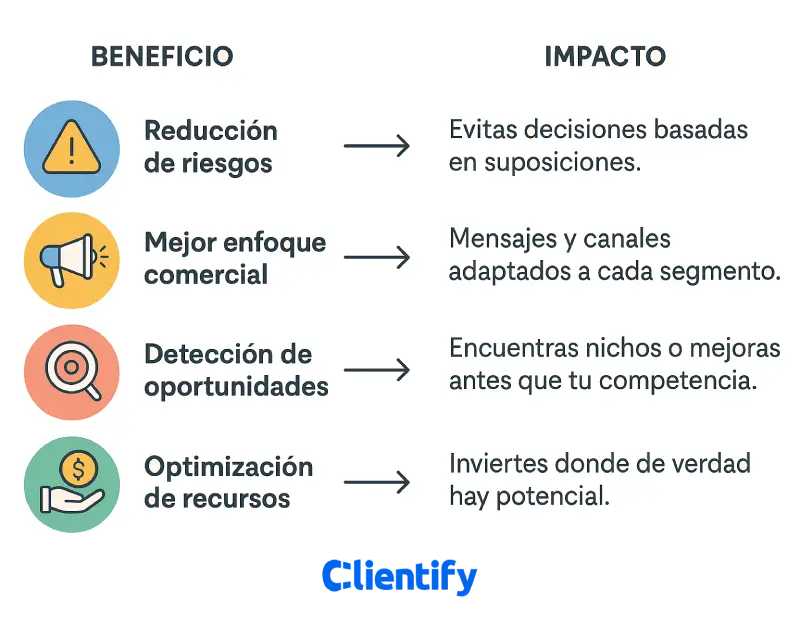

As a table that is very well understood, a well done market study gives you:

| Benefit | Impact |

|---|---|

| Risk reduction, especially at the beginning. | You avoid decisions based on assumptions. |

| Improved commercial approach | Messages and channels adapted to each segment. |

| Detection of opportunities | You find niches or improvements before your competition. |

| Resource optimization | You invest where there is real potential. |

Examples of Market Studies by sector

Here you have a series of examples of how a Market Study helped several companies both at the beginning of their journey as well as in an advanced stage of the company.

Education and training

An online academy was seeing its enrollment drop every quarter. They thought it was because of the price, but a market study revealed something different: the problem was the format.

They discovered that students wanted recorded classes to adapt to their schedule. With this information, they redesigned the offer and not only recovered enrollment, but also increased enrollment by 30%.

Industry and manufacturing

A manufacturer of industrial parts wanted to export to new markets.

They were betting on Germany because of its reputation in the sector, but the study showed that Poland had less competition, lower tariffs and growing demand. They changed their strategy and closed contracts in half the time.

E-commerce

A fashion ecommerce was seeing a lot of abandoned carts. The analysis revealed that it was not because of the price, but because of the shipping costs. They implemented free shipping from a minimum amount and conversion went up by 30%.

IT, telecommunications and software

One SaaS company was losing users during the trial period. They thought the problem was price, but the study showed that many did not understand how to use key features.

They redesigned onboarding and added interactive tutorials, resulting in more than 50% of trial users becoming customers.

Marketing agencies

An agency with good results in several sectors did not know where to focus its recruitment.

The study analyzed acquisition costs, average ticket and closing times, identifying that the healthcare sector offered the best ROI. They concentrated their investment there and doubled revenues in one year.

Travel Agencies

An agency specializing in exotic travel wanted to increase sales in low season. The study identified destinations with good weather and high demand in those months.

They created promotional packages and communicated them through segmented campaigns on WhatsApp, filling previously empty groups.

Health, beauty and wellness

One aesthetic clinic noticed that several treatments were going unbooked despite being on trend. The study found that the problem was a lack of confidence in the results.

They added testimonials and real cases in their communication, increasing bookings by 40%.

Professional Services

A generalist law firm failed to differentiate itself. The study showed that SMEs in their area were primarily looking for labor law advice.

They specialized part of the team in this service and promoted it as their main differential value.

Common mistakes in a Market Study and how to avoid them

Doing a market study does not mean that you are immune from mistakes, but you can reduce them, here you have them briefly defined:

- Define vague objectives.

- Working with unrepresentative samples.

- Forget about analyzing the competition.

- Do not activate what has been learned in workflows.

- Do not measure impact from the beginning.

Quick checklist for your market research

Before you jump into collecting data and analyzing charts like a locomotive, it’s a good idea to make sure you have all the essentials in place.

A market study does not start with the spreadsheet, but with the previous planning: knowing what you are going to look for, how you are going to measure it and with which tools you are going to do it.

This checklist is your checkpoint before getting started. If you complete it, you can be sure that your research will not be half done and that each step will be aligned with your business objectives.

- Have a clear objective for the study, if you have several objectives you may need several studies.

- Buyer persona defined; who you go for.

- Methodology adjusted to the question. It is better to err on the side of terseness rather than baroque when it comes to methodology.

- Have the tools ready, and control their use well. Many studies fall down by not knowing how to work with the data (here are a few recommendations for data collection tools).

- And of course, draw up an analysis plan and have those KPIs well defined.

And remember…

A market study is not an expense, it is an investment… but of course, you can always continue to make decisions “by eye” and let chance guide your business.

But if you prefer to reduce risks, find opportunities before the competition, speak to your customer in their language and optimize resources to make every euro and every hour count, then data is your best friend.

The difference between improvising and deciding with data is like cooking with a recipe or with what you find in the fridge: in one case it comes out something repeatable and successful, in the other… well, sometimes it works.

With the right tools, like the ones you have on Clientify and out there, going from theory to action is faster than you think.

So, either you let the wind decide your course, or you take the helm with a clear map. The choice is yours.